Specific credit unions simply require that you inhabit a certain town otherwise town

Lượt xem:

How do you become a member? You will probably should be a member of a group so you can have fun with a card connection and its services, but this is exactly easier than it may sound. Particular appeal to team who work in one company. While others associate with places of worship or universities. It is possible to be able to subscribe when the a close relative was already an associate.

Something to keep in mind on the borrowing from the bank unions is the fact they’re smaller than many banking institutions. So there tends to be less metropolises, ATMs, bank card choice and you may bank card advantages programs. step 1

The newest FDIC will not guarantee borrowing unions, however, the latest National Borrowing Connection Government (NCUA) offers the exact same brand of security to help you federally chartered borrowing unions.

Online-merely banking While most financial institutions today render on line attributes, there are also banks available exclusively on the web. With straight down performing expenditures, those people offers is sometimes passed along to customers in the form of straight down monthly costs or more interest levels toward coupons membership.

Telephone financial Some finance companies enable you a choice of financial of the cellular phone. For many who label away from the bank’s regular business hours, you may have to explore an automatic program which can simply take you through the methods wanted to complete the purchases.

Financial services and products

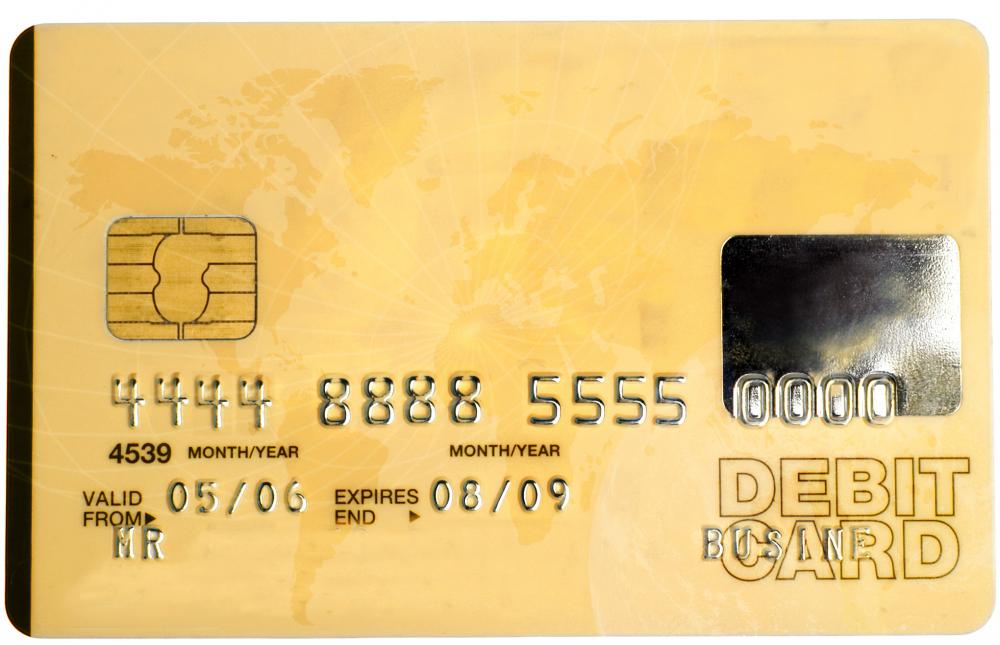

Bank account While thinking about just what attributes banking companies promote, a checking account will be the to begin with you see. That it preferred sort of account makes you store and you may do the cash make use of to own informal purchasing. After setup, you are able to a beneficial debit cards or have a look at, that takes money right from your account, to pay for many techniques from groceries so you’re able to fuel to debts. In addition there are cash from an automatic teller machine otherwise branch playing with your own debit cards and you can PIN, a unique code you choose to manage your bank account.

Savings account A family savings helps you separate the cash we should save your self regarding the currency you should purchase. For some, it is a better way to operate into a target, such as for instance saving to possess renovations otherwise building a crisis financing. Most discounts levels can also be immediately move funds from your own bank account in the savings account each month, you usually do not even have to think about do-it-yourself. A bonus would be the fact financial institutions always spend your desire towards offers levels. That’s totally free money that may help you reach finally your economic wants a tiny less.

Currency industry membership (MMA) An MMA is a type of family savings that often will pay highest rates than simply a consistent family savings. The more you place out, the greater you’re able to earn. One thing to bear in mind? There is going to also be constraints about precisely how many distributions you can make monthly.

Certification out of deposit (CD) A great Video game is a kind of savings account where you agree to help keep your cash in the fresh new be the cause of a quantity of time. The time can differ, but terminology have a tendency to range from as low as six months to help you provided five years.

Just phone call a phone number and you can consult with a lender staff doing things such as look at your balance, transfer money, pay bills or handle most other financial requires

The newest prolonged you save, the more the newest go back. You can want to withdraw your finances early. However, there is a punishment having withdrawal before prevent of your Computer game name.

Debit credit That have a good debit card, you could CA direct online installment loans purchase everyday costs with only an excellent swipe (and usually their PIN). The money may come right from their family savings so there was no reason to hold cash if you’d like not to. Also, in case your debit card is destroyed or stolen, you may not be responsible for unauthorized transactions if you statement it in a timely manner. Shed bucks, regrettably, is oftentimes destroyed for good.