Home loans getting Nurses: What are the Possibilities?

Lượt xem:

Mortgage loans to possess nurses try approved based on how much exposure they angle off not being able to pay-off the loan. You could slow down the chance your angle on your lender’s vision because of the meeting next items: Possess steady work, and that you have been in for over a couple of years (or at least in the same field along with an equivalent condition for it day).

Regrettably, most banks that have a beneficial d do not offer it to nurses. There are nurse professional mortgage loans and you may nurse anesthetists (CRNA).

CalHERO Home loan | Ca Mortgage broker.

. Discounted cost to possess mortgage loans. Improved limitation credit wide variety. Totally free a dozen-few days domestic warranty. Provides and you may rebates. Borrowing from the bank at the closure. Discounts for house-related properties (is sold with movers, carpet cleaning, assessment, and a lot more). We help you arrive at owning a home. Zero catch. Zero undetectable charges.

Home loans getting Nurses: New Definitive Guide – Huntsman Galloway.

OHFA deals with lenders, borrowing from the bank unions and you can home loan enterprises over the state. Find an enthusiastic OHFA-acknowledged lenderin your area, as well as suggestions to assist you with the application form process, otherwise e mail us cost-free from the . Associated Hyperlinks OHFA Homebuyer Program YourChoice! Down-payment Recommendations Grants getting Grads Kansas Heroes Home loan Taxation Borrowing. The only disadvantage to help you Frandsen’s doctor mortgage system is they wanted no less than 5% advance payment. You should buy 95% funding up to $1.25M otherwise ninety% financing to $2M. The main benefit of to make a down-payment, but not, is you are likely to get a lower interest rate. Click to learn more about Frandsen.

Ohio Heroes | My Kansas Home.

Home mortgage alternatives for take a trip nurses Together with nursing assistant household money , simple financing brands can be worth looking into. Believe it or not, zero mortgage brokers.

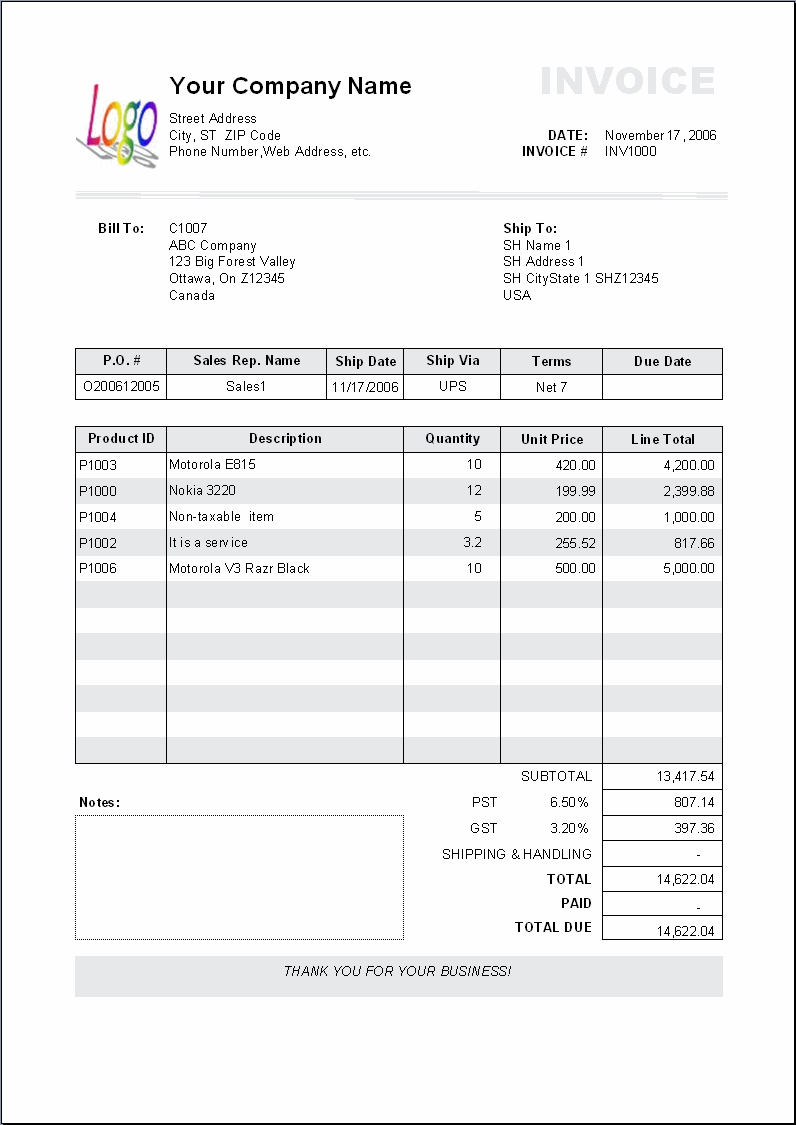

eight Greatest Breastfeeding Student loans off – NerdWallet.

Members of the job hoping to get good FHA loan have to have a credit history of at least 580 to locate a mortgage which have an advance payment off step 3.5%. Likewise, to get a traditional financial, you usually need a credit history out-of 640 and you can significantly more than. Down repayments for antique loans cover anything from step three% to 20%, based on your credit score. Zero app charge / Zero up-front side charges Easy application process or more-top pre-approval. Zero cuatro-hours household visitors class Simple Docs System Low down payment alternatives for first-time homebuyers. Pick Any family in the industry Provides up to $8, (Where available) Advance payment Guidelines as much as $ten, Lenders having very first time homebuyers.

Greatest Mortgages for Traveling Nurses – Dream A mortgage.

: Buy One household in the market Grants doing $8, (Where available) Down payment Guidance up to $10, Mortgage brokers to possess nurses and healthcare specialists Simple Docs who does lot loans in Aspen Park Colorado System No application costs No right up-top costs Zero Representative fees Prominent interest levels Totally free assessment (around $ borrowing on closing). First time Household Client Program. Nurse Next Door’s first-date domestic buyer system support nurses and other qualified public-service masters read the dream about to get new house customers. So it special system integrates gives, advance payment advice and other special benefits to have very first-date consumers. More information!. FHA funds are perfect for take a trip nurses that has reduced credit ratings, otherwise you prefer a little deposit. The loan program may also be helpful one to be eligible for an excellent high price than simply a normal loan. Among the many other professionals are FHA money accommodate the newest vendor to simply help shelter the fresh new settlement costs. You can also get something special out-of a family member to simply help.

Mortgage loans For Take a trip Nurses | 2023 Home buying Publication.

You are going to found sixty% of your overall the, being qualified, breastfeeding studies funds during the period of 24 months. After the a few-12 months service bargain, you happen to be qualified to receive a 3rd year and a supplementary 25% of your own funds. This type of fund aren’t excused out of government income and you will a position taxes. The thing that makes the latest Nurse Corps LRP extremely important?.