Do you Score a beneficial USDA Financing? This Chart Will tell you

Lượt xem:

If you’re looking to possess a more rural and you can suburban lives – in which the cost-of-living is normally all the way down – an effective USDA mortgage could save you money on your own off percentage and interest rate.

The capacity to work remotely has created a special chance to live everywhere you would like. As COVID-19 restrictions is actually slow lifted, more than a third off professionals declaration proceeded to work regarding family regardless of their workplace starting backup.

Discover an individual issue – discover a good USDA mortgage, you should see a qualified possessions. That’s where the latest USDA financial chart will come in.

What is actually a great USDA Mortgage, and just how Do you really Get You to?

Mortgage loans on You.S. Agency away from Farming was fund which can be designed to assistance lowest-earnings group in finding sensible property outside of significant towns. These funds are usually a good option getting borrowers which would not if you don’t qualify for a timeless mortgage.

Exclusive benefit of an effective USDA financing is that it generally does not require a downpayment – which might be the greatest financial hindrance so you’re able to homeownership. The fresh new money work at having 29-12 months words on fixed interest levels (a student loan refinance rates fixed bit less than old-fashioned fund) and can be employed to get proprietor-occupied, single-nearest and dearest home and you may apartments.

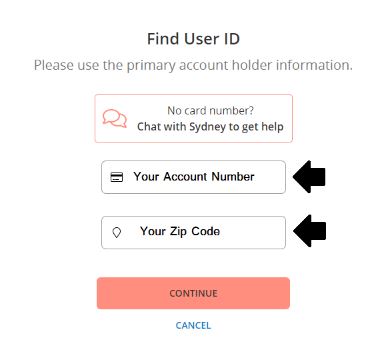

The USDA application for the loan process starts with determining their qualifications, hence utilizes your income, credit score, or any other financial obligation. For individuals who meet the requirements, you can manage a USDA-accepted mortgage lender so you’re able to safer a mortgage pre-approval and commence in search of USDA-accepted land.

Eligibility Conditions for USDA Lenders

New regards to an excellent USDA loan shall be high, but they’re not for everyone. To ensure that you have a tendency to qualify for you to, you’ll want to meet with the following the criteria:

- Your income should be within this 115% of your average domestic income limitations given for the city

- You should be a beneficial You.S. Resident, U.S. non-citizen national, otherwise certified alien

- You will probably need a credit history regarding 640 or above

- Debt obligations shouldn’t meet or exceed 41% of one’s pre-income tax earnings

- You must agree to personally inhabit the dwelling since your no. 1 household

- It should be located inside an eligible outlying city

- It ought to be a single-nearest and dearest house (with condos, modular, and you can were created home)

- There is absolutely no acreage restrict, although value of the residential property ought not to surpass 29% of the value of the house

Expert Suggestion

Before you can score dependent on your brand new prospective home, read the USDA interactive map to see if it is eligible.

Exactly what Qualifies since an effective Rural Area

Before you fall for one particular home, you will need to discover and therefore areas in the region qualify to your USDA program. How the USDA describes rural parts utilizes your geographical area.

In general, these types of section is identified as unlock country that isn’t element of, on the any urban area, said Ernesto Arzeno, a mortgage inventor having Western Bancshares.

The brand new rule of thumb was parts having an inhabitants having less than simply ten,100000, Arzeno told you, even if you to signal is not hard and you can fast. For most portion, based on homeownership rates, the USDA lets populations doing 35,one hundred thousand, but do not higher than you to definitely. Therefore the designations may changes just like the USDA recommendations her or him all of the while.

How to use the fresh new USDA Mortgage Chart

The brand new USDA’s interactive financial map is the equipment you to definitely lets you can see when the a property is eligible. It functions in two implies: You can look personally to the target regarding property you will be given, and this will leave you a response in the qualifications. Otherwise, you could navigate around the chart to determine what elements basically are considered outlying.

- Discover new USDA Financial Map right here.

You’ll find that with this particular chart isnt thus different than playing with Google Maps or any other similar tools. However, here are some things to think about while using the USDA mortgage map:

Try an excellent USDA Home loan Effectively for you?

USDA Home loans can be a pathway in order to homeownership, particularly if you are looking to live away from a big urban area. But with any loan, discover positives and negatives. Here is what to look at.

A monthly funding commission (the same as personal home loan insurance) was put in the borrowed funds percentage. It can’t getting canceled shortly after interacting with 20% equity.

It is critical to highlight new economic disadvantages. Bypassing an advance payment setting you’ll have a big loan total shell out focus on. In addition to, a monthly investment commission commonly make an application for the full lifetime of one USDA financing. With that, make sure you consider all of the home loan money options to discover which is the most useful fit for your.